If you’re considering a cash envelope system or if you’ve dabbled with it and didn’t succeed, my goal with this post is to share the categories that I pay cash for in our budget.

This post contains affiliate links.

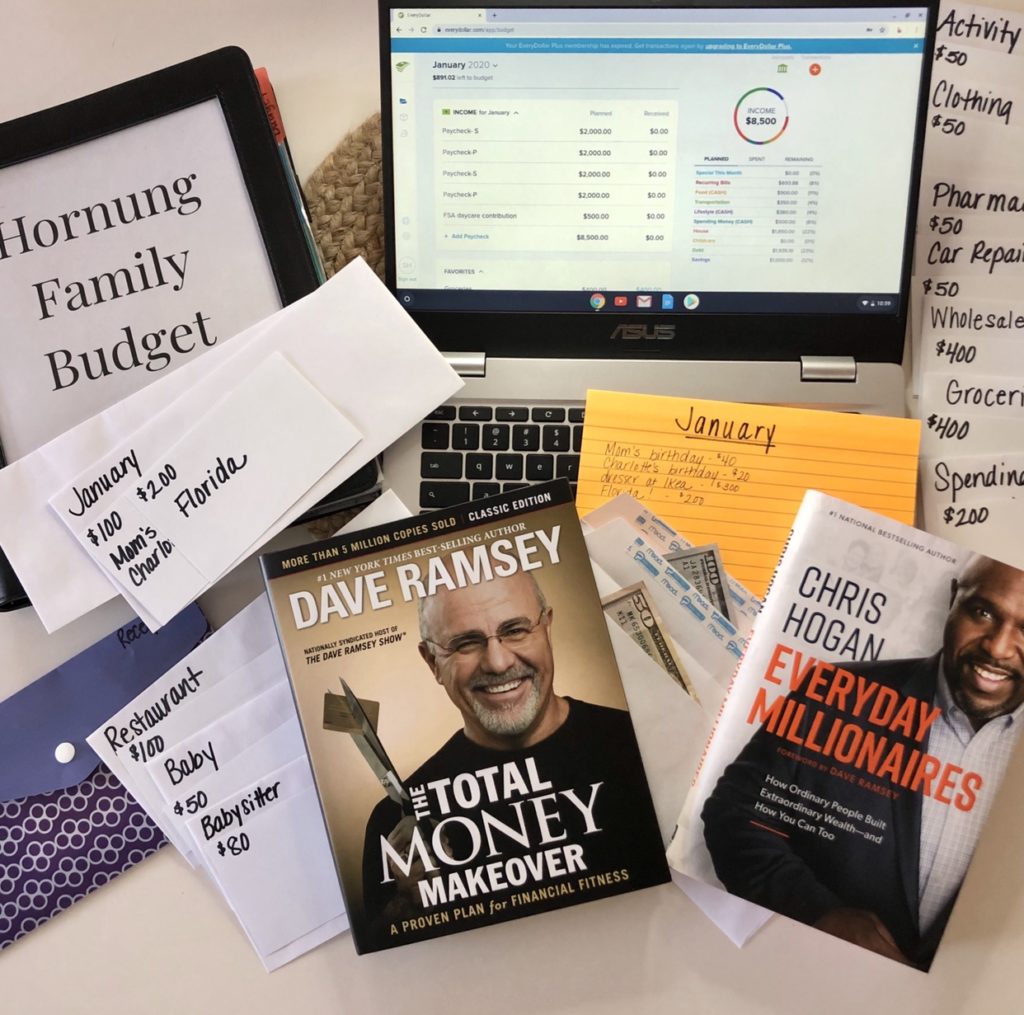

Using envelopes has been the number one way that I have managed to live within a budget. I started using the envelopes after reading The Total Money Makeover by Dave Ramsey. It is the best book to read if you are just starting out or if you need some motivation to get back on track!

Why Pay Cash?

Paying cash has tons of benefits when you are budgeting. It brings a sense of control when you physically separate the cash into categories and envelopes and cuts you off when you are out of money, which a credit card or debit card will not do. It’s also more painful to pay for things in cash which makes you intentional and cautious about what you are spending money on. In fact, research has been done that supports why paying cash is more painful to consumers than using a credit card or a gift card.

“the more transparent the payment outflow, the greater the aversion to spending or higher the ‘pain of paying’ …leading to less transparent payment modes such as credit cards and gift cards (vs. cash) being more easily spent or treated as play or ‘monopoly money.’”

-Psychology Today

In a 2008 study, researchers Raghubir and Srivastava argued that using credit cards dulls the ‘pain of paying’ for two important reasons. The first is the separation in time between when the credit card is used to buy something and when the bill has to be paid. The second is that using a credit card allows different purchases to be mixed together, so when the bill is actually paid, you are not able to attribute the payment to any one particular purchase.

What I Use Cash For

When I tell people I use the envelope system and pay cash, there is often a misconception that I pay for everything in cash or checks, which is not true. Here is a breakdown of the categories in our budget and what I use to pay for each.

Automatic Debit Draft

These are scheduled payments that happen automatically.

- Utilities

- Cell Phone Bill

- Mortgage

- Life Insurance

- Car Insurance

- Cleaning Service

- Student Loan

- College Savings Program

- Daycare (check)

- Car Payment (check)

Did you know you can request a particular due date for almost every bill you pay? If you feel overwhelmed by paying bills because they seem to fall at inconvenient times or maybe they are all due at the same time, you can call and request a new due date. Most major companies have the option online when you are paying your bills as well. I have personally found that it’s helpful to try to schedule my auto pay bills toward the end of the month so I can withdraw the cash for my envelopes at the beginning of the month.

Debit Card

- Gas

- Online purchases

Cash

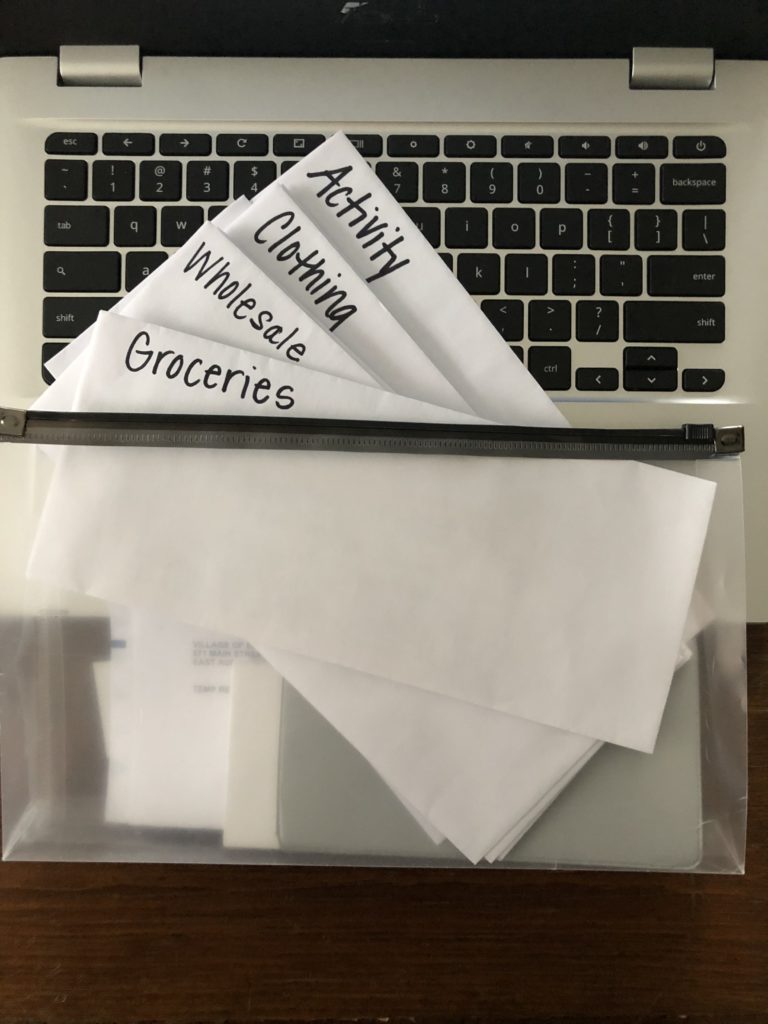

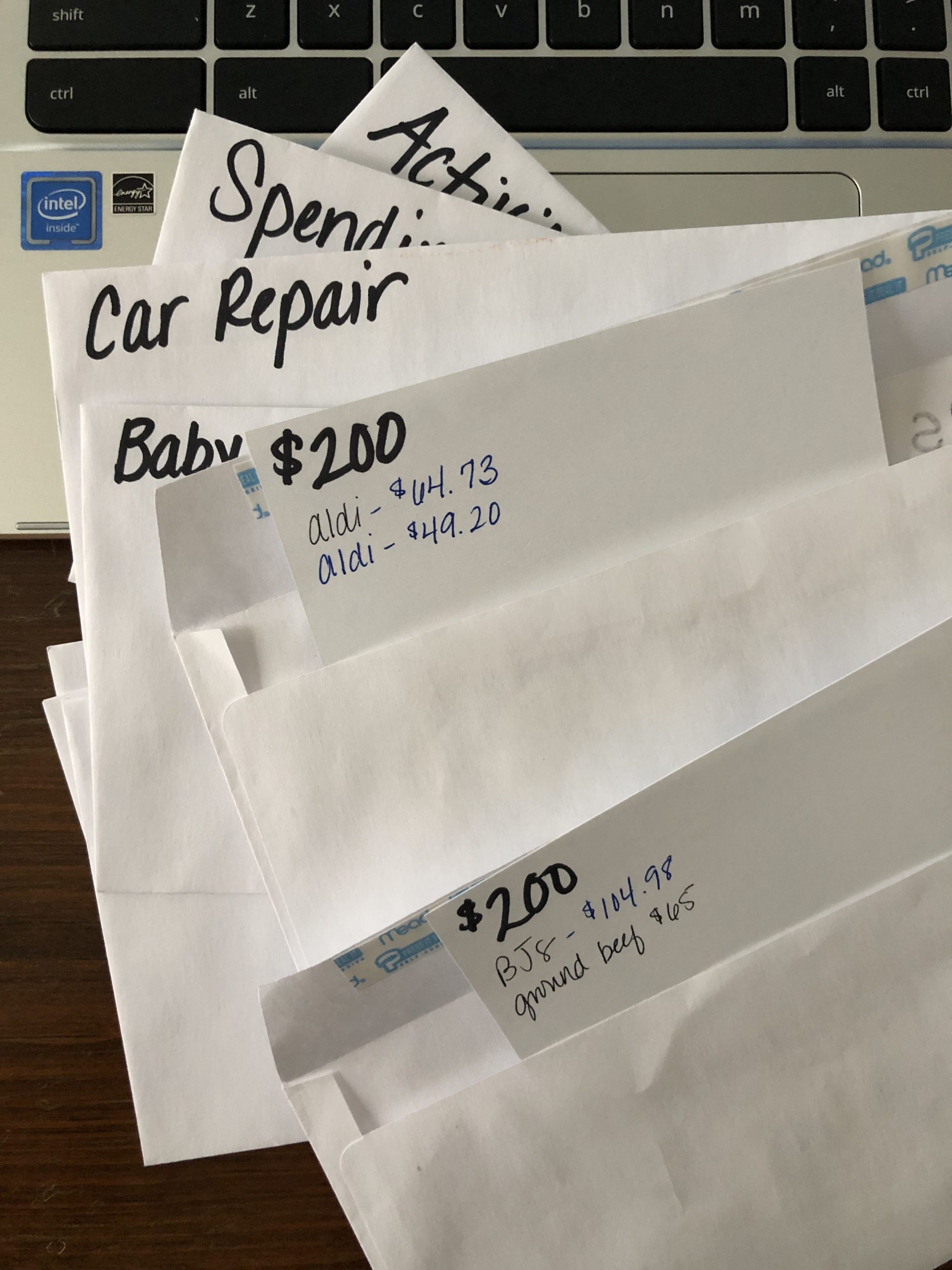

The following are the categories that I use cash for, which means each and every one of these categories has an envelope. Some people don’t get as granular with their envelopes but this helps me to really see and feel where our money is going, and it holds me accountable to be that specific. If I had a generic envelope called “food”, I could easily justify trips to Starbucks, pizza nights, snacks at Target and Girl Scout cookies from the neighbor in that category. Instead, I have an envelope for groceries, restaurants, wholesale groceries and spending money. I try very hard to only purchase groceries at the grocery store and I consider all of those other things I mentioned part of my spending money because they are truly unnecessary.

Here are the categories and the approximate amount that I assign per month:

- Groceries- $400

- Wholesale club- $400

- Restaurant- $80-100

- Babysitter

- I only include money in the babysitter envelope when we have something scheduled that month to require one.

- Special Month

- This is an envelope that I put specific cash in for special things happening that month. i.e. birthdays, trips, weddings, registration fees for sports, parties, haircuts, events. At the beginning of the month I look at our family calendar and estimate how much money we will need based on what is on the calendar.

- Pharmacy- $50

- Home Improvement- $50

- Clothing- $50

- Activity- $50

- Car Repair- $50

- I always budget $50 to have for smaller things that may come up like an oil change, but if we don’t use it I will set it aside into a sinking fund to save for a more expensive car repair that is inevitable in the future.

- Baby- $50

- Spending Money (we each get our own)- $250 each

Spending Money

One of the questions I was asked a lot recently was how you decide how much spending money you should get. I don’t think there is a right or wrong answer for this, I think it depends on the person and the other categories in your budget.

When I first started budgeting, I was very lean with spending money. I tried to only take $100 a month because I was trying to squeeze every dollar out of our budget to make progress faster. I ended up feeling really restricted and that made it harder to stay on track. I think there are a lot of similarities between budgeting and dieting. If you are dieting and you deprive yourself and try to get too strict with what you eat, you wind up falling off the wagon. I would rather cushion our spending money and hope I don’t use it all, than feel desperate and buy something I couldn’t afford. Some months we get more spending money than others, it depends what else is going on. If we are going on a trip or have a lot of unusual expenses one month, spending money will sometimes go down.

Spending money should be considered free money to do whatever you want with. If you are budgeting with your spouse, I suggest setting ground rules for spending money (i.e. we both use spending money for haircuts, clothing, takeout at work). You don’t want one person to be scraping off the restaurant budget for lunch during the work week while the other person is using their spending money on it. Another way to decide if someone should use spending money is if the purchase will only benefit that person and not the whole family. Other than that, it’s yours to do what you want with and you shouldn’t comment or criticize what the other person uses it for.

I hope this information answers your questions about envelopes and paying cash, and inspires you to give it a try! If you’re looking for a budgeting template, be sure to subscribe to my mailing list while you’re here to receive a free Google Sheets template.